Bottomline Enterprise Solutions: Digital Payments, Treasury Automation & Financial Messaging (Comprehensive Guide)

Introduction

Modern enterprises must manage complex payment ecosystems that involve multiple banks, ERP systems, treasury teams, and regulatory requirements. As organizations scale, fragmented workflows and manual approvals can create operational inefficiencies and compliance exposure.

Bottomline delivers enterprise-grade digital payment automation and financial messaging solutions designed to centralize financial operations. This guide explains how Bottomline works, its architecture, and how enterprises leverage the platform to streamline treasury and payment processes.

Company Overview: Bottomline Technologies

Bottomline Technologies is a financial technology provider specializing in:

- Enterprise payment automation

- Secure financial messaging connectivity

- Treasury and liquidity management

- Risk monitoring and compliance frameworks

Bottomline serves financial institutions, corporate enterprises, healthcare systems, insurance providers, and public sector organizations globally.

Bottomline Core Platform Components

4

1. Digital Payment Automation

Bottomline supports automation of:

- Supplier and vendor payments

- Domestic and cross-border transfers

- Treasury disbursements

- Multi-tier approval workflows

Automation improves processing speed and reduces manual errors.

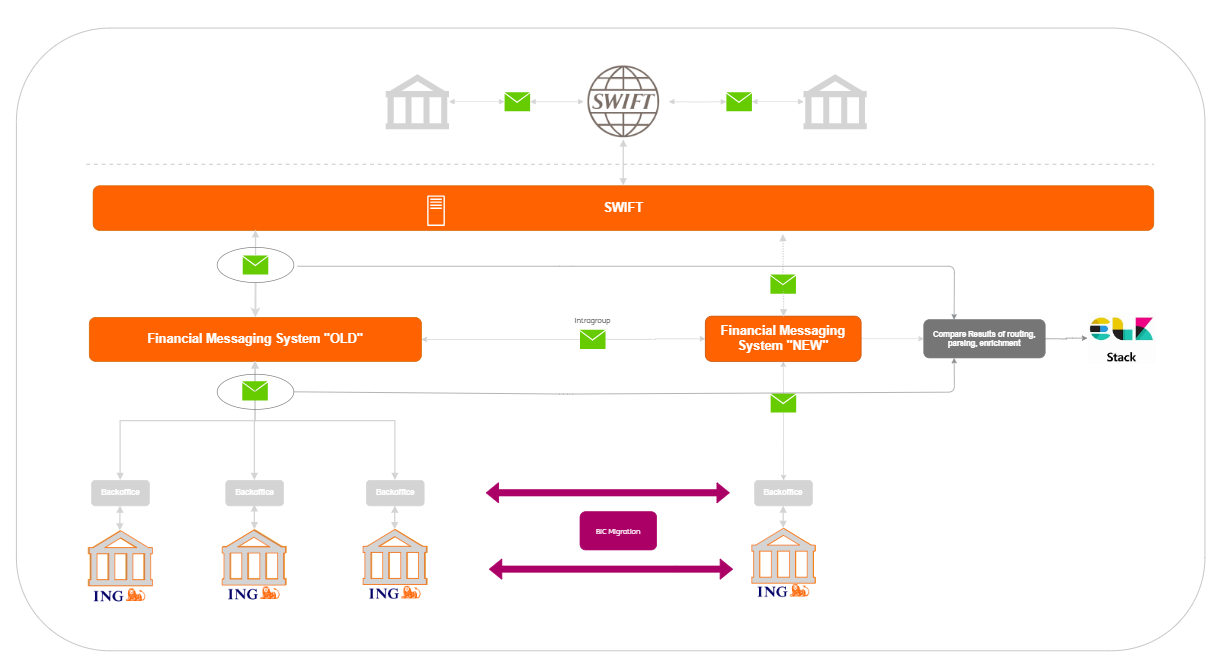

2. Financial Messaging Network

The platform enables secure transmission of payment files between ERP systems and banking institutions. Structured validation reduces operational risk.

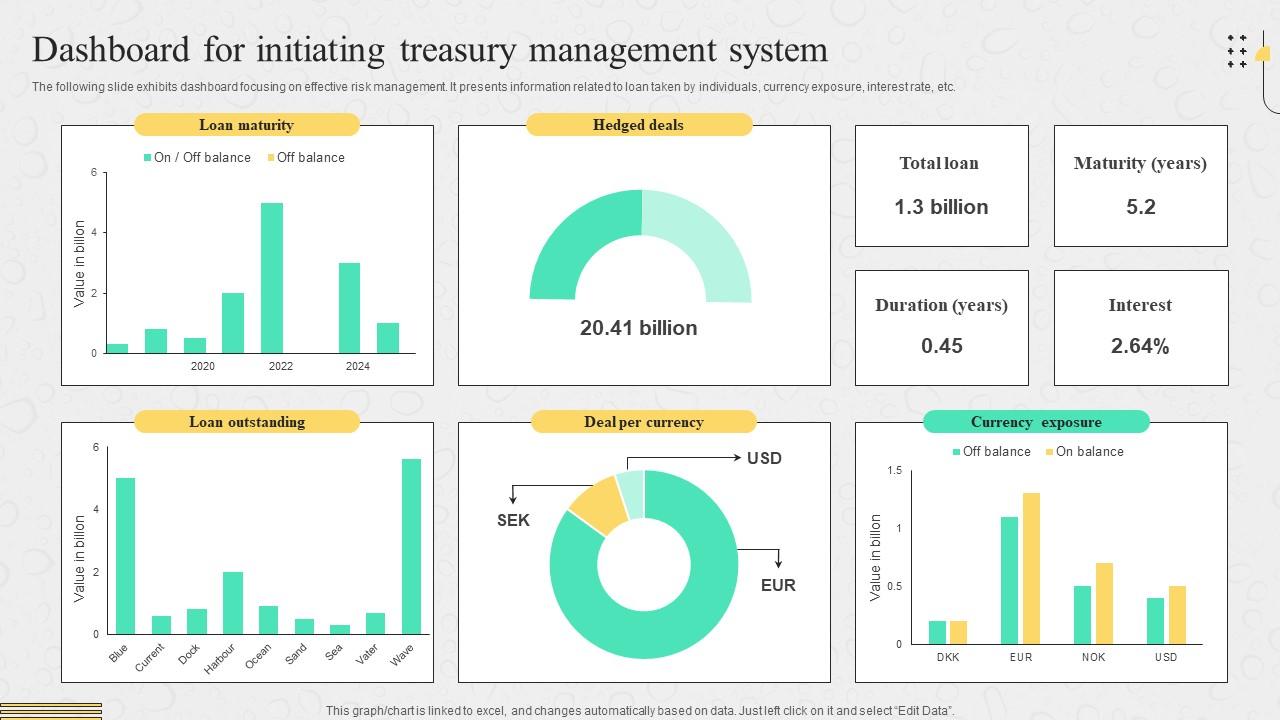

3. Treasury & Liquidity Visibility

Finance teams gain access to:

- Real-time cash positioning

- Liquidity forecasting tools

- Payment scheduling dashboards

- Reconciliation reporting

Centralized visibility enhances financial decision-making.

4. Compliance & Governance Controls

Bottomline integrates approval hierarchies and transaction monitoring tools that support governance standards and regulatory alignment.

How Bottomline Works in Enterprise Environments

Bottomline typically integrates with:

- ERP platforms

- Accounting software

- Treasury management systems

- Banking networks

A typical payment lifecycle includes:

- Payment creation within ERP

- Secure financial messaging transmission

- Automated validation and internal approvals

- Monitoring, reconciliation, and reporting

This centralized model reduces system fragmentation and increases transparency.

Key Features of Bottomline

Enterprise-Grade Security

Encrypted transmission protocols and role-based access controls help protect financial information.

Configurable Workflow Automation

Customizable approval chains strengthen internal financial governance.

Centralized Reporting & Analytics

Real-time dashboards provide visibility into payment performance and liquidity status.

Scalable Infrastructure

Bottomline is designed to support enterprise-scale transaction volumes.

Industry Applications

4

Bottomline solutions are widely implemented in:

- Banking and financial services

- Corporate treasury departments

- Healthcare systems

- Insurance organizations

- Public sector institutions

Organizations managing large payment ecosystems benefit from centralized automation.

Strategic Advantages of Bottomline

Improved Operational Efficiency

Automated workflows reduce manual processing and accelerate payment cycles.

Enhanced Financial Transparency

Central dashboards improve oversight of transaction activity and liquidity.

Regulatory Alignment

Built-in compliance monitoring tools support governance requirements.

Risk Mitigation

Configurable approval processes reduce internal payment errors and strengthen controls.

Bottomline vs Disconnected Payment Systems

| Capability | Bottomline | Disconnected Systems |

|---|---|---|

| Payment Automation | Integrated | Limited |

| Financial Messaging | Centralized | Separate portals |

| Treasury Visibility | Real-time dashboards | Fragmented reports |

| Compliance Monitoring | Built-in | Manual |

| ERP Integration | Seamless | Complex |

Disconnected systems often increase operational complexity and risk exposure.

Frequently Asked Questions

What is Bottomline?

Bottomline is a financial technology company providing enterprise payment automation and financial messaging solutions.

Who typically uses Bottomline?

Financial institutions, corporations, healthcare providers, insurance companies, and public sector organizations.

Does Bottomline integrate with ERP systems?

Yes, ERP integration is a central component of the platform.

Is Bottomline designed for enterprise environments?

Yes, it supports high-volume transaction processing and complex financial ecosystems.

Conclusion

Bottomline delivers enterprise-focused digital payment automation, treasury management, and financial messaging solutions. By centralizing workflows, compliance controls, and reporting dashboards, Bottomline helps organizations modernize financial operations and reduce operational complexity.

For enterprises seeking scalable, secure, and integrated payment infrastructure, Bottomline provides structured automation designed to enhance efficiency and financial visibility.